Understanding the Value: 45.6 Billion Won to USD – Conversion, Context, and Implications

In a world increasingly interconnected by global trade, investment, and digital transactions, currency conversion plays a critical role. Whether it’s for business, travel, or financial reporting, understanding the value of one currency in terms of another is vital. One such conversion that has caught attention recently is 45.6 billion South Korean won (KRW) to U.S. dollars (USD). This figure might appear in news articles, business deals, or entertainment headlines, and unpacking its meaning offers insight into currency exchange dynamics, economic indicators, and global financial relevance.

1. Currency Conversion Basics

Before diving into the specifics, let’s look at what currency conversion means.

Currency conversion is the process of converting the value of one country’s currency into another’s. This is typically done using the foreign exchange rate (forex rate), which fluctuates daily due to market conditions.

As of May 2025, the average exchange rate is approximately:

1 South Korean Won (KRW) ≈ 0.00073 U.S. Dollars (USD)

This means that to convert won to dollars, you multiply the amount in won by the exchange rate.

Conversion of 45.6 Billion Won to USD

To convert:

CopyEdit

45,600,000,000 KRW × 0.00073 USD/KRW = 33,288,000 USD

So, ₩45.6 billion equals approximately $33.29 million USD (rounded to two decimal places).

2. Where Might You See This Amount?

This sum might appear in several scenarios:

- Business Investments: Korean conglomerates (chaebols) investing in the U.S. or global markets.

- Entertainment Deals: K-pop labels or film producers securing overseas distribution or promotional budgets.

- Government Budgets: Cross-national aid, defense, or science projects.

- Real Estate Acquisitions: Purchasing commercial property in another country.

- Cryptocurrency and Tech Investments: With South Korea being a tech-savvy nation, digital asset purchases or startup funding deals could reach this amount.

3. The Economic Power of 45.6 Billion Won

To the average person, 45.6 billion won may seem like an abstract number, but let’s put it into perspective.

- In South Korea:

- It could fund the construction of several high-rise apartment complexes.

- It’s enough to support mid-size municipalities’ budgets for public services for a year.

- Equivalent to the average salaries of around 7,000 people for one year (assuming ~₩65 million/year average salary).

- It could fund the construction of several high-rise apartment complexes.

- In the United States:

- $33.29 million USD could purchase a medium-size tech company.

- It could finance an independent film with a large marketing budget.

- It’s more than the annual budget of some small towns in America.

- $33.29 million USD could purchase a medium-size tech company.

4. Historical Exchange Rate Context

The value of the Korean won has fluctuated against the U.S. dollar over time, impacted by:

- Interest Rate Differentials

- Economic Stability

- Trade Balance

- Political Factors

In the last decade:

- In 2015, the rate hovered around 1,100 KRW/USD.

- During COVID-19, the won weakened to around 1,300+ KRW/USD.

- As of 2025, it’s stabilized near 1,370 KRW/USD, influenced by inflation and central bank policy.

Therefore, 45.6 billion won might have been worth more or less depending on when the conversion happened.

5. Real-World Examples of 45.6 Billion Won Transactions

To bring this to life, let’s explore examples where this figure appears:

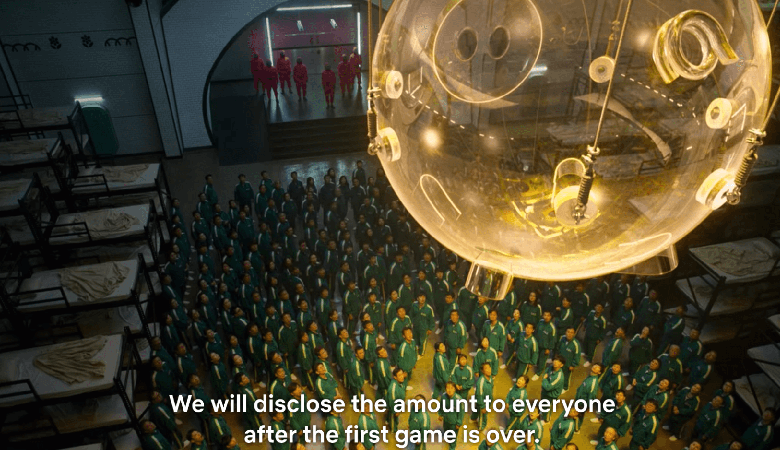

A. Entertainment Industry

The South Korean entertainment industry has seen massive investments. Companies like HYBE, SM Entertainment, and CJ ENM regularly deal with multi-billion won contracts. For instance:

- A joint venture between a Korean production company and a U.S. streaming platform might cost 45.6 billion won.

- The budget for a high-profile K-drama could easily reach ₩30-50 billion, especially if it stars top Hallyu actors.

B. Technology & Startups

South Korea’s push to be a global AI and blockchain leader means government-backed tech initiatives often reach into the tens of billions of won.

- A government-funded AI innovation program in Seoul might be allocated ₩45.6 billion over two years.

- A major Series C funding round for a fintech startup could total that amount.

C. Sports Contracts and Sponsorships

With Korea’s growing sports industry:

- A long-term sponsorship deal with a global brand for a K-League team or an Olympic initiative might be valued at 45.6 billion won.

- Transfer fees for star Korean athletes moving to European or American leagues might approach this amount.

6. Impact of Exchange Rates on International Business

The fluctuation of exchange rates can significantly affect the real value of a deal:

- If the won weakens, the same amount in KRW buys less in USD.

- A stronger dollar can hurt Korean importers but benefit exporters.

- For investors, hedging strategies are used to protect against exchange rate risks.

Example:

If a Korean investor signs a $33 million deal and the won drops to 1,400 per USD (from 1,370), they would now need:

CopyEdit

33,000,000 × 1,400 = 46.2 billion won

That’s ₩600 million more, purely due to exchange rate shifts.

7. The Role of Central Banks

The Bank of Korea (BOK) and the U.S. Federal Reserve (Fed) influence currency values through:

- Interest rate changes

- Foreign currency reserves

- Open market operations

If BOK raises interest rates, the won might strengthen, making future 45.6 billion won deals more valuable in USD.

8. Cultural Significance and Perception

In South Korea, public perception of large financial figures is colored by:

- Media portrayal: ₩45.6 billion would be headline news in cases of corruption, celebrity income, or government spending.

- Wealth disparity: With the average home in Seoul costing over ₩1 billion, a ₩45.6 billion asset implies serious capital.

- K-pop influence: Fans often track how much companies spend on tours, albums, and promotions. Multi-billion won figures draw social media buzz.

9. Digital Currency and Cryptocurrency

Given the tech-forward nature of South Korea:

- Crypto trades and ICOs (Initial Coin Offerings) involving ₩45.6 billion are not uncommon.

- With platforms like Upbit and Bithumb, large-scale digital asset purchases in KRW can affect market sentiment.

- Regulations by the Financial Services Commission (FSC) ensure compliance in high-value transactions.

10. Future Implications: A Stronger Won or a Weaker One?

Analysts debate the future trajectory of the won. Factors include:

- U.S. economic strength

- China’s economic slowdown (as a major Korean trade partner)

- Domestic inflation control

If the won strengthens to 1,200 per USD, that ₩45.6 billion will become:

bash

CopyEdit

45,600,000,000 / 1,200 = $38 million USD

A significant difference that can affect planning, reporting, and ROI.

Conclusion

The conversion of 45.6 billion won to USD, roughly $33.29 million, is more than just a simple math problem. It represents a complex web of economic relations, cultural weight, international business strategy, and future speculation. Whether in the world of entertainment, tech, real estate, or finance, such figures illustrate South Korea’s global economic footprint and the critical importance of understanding currency dynamics.

With an economy as advanced and dynamic as South Korea’s, large-scale figures like ₩45.6 billion will continue to make headlines and shape international deals. And as global investors, observers, or curious minds, grasping what this amount means in real-world terms helps us better interpret the headlines and opportunities of today’s interlinked economy.